2021 was a banner year for Israeli startups, breaking new records in fundraising, new unicorns, and exits. But if we take out the rose-coloured glasses, what are the risks ahead? What comes next?

In this post I review the potential risks for the Israeli tech ecosystem and the mitigating factors that counter some of them.

Where are we now?

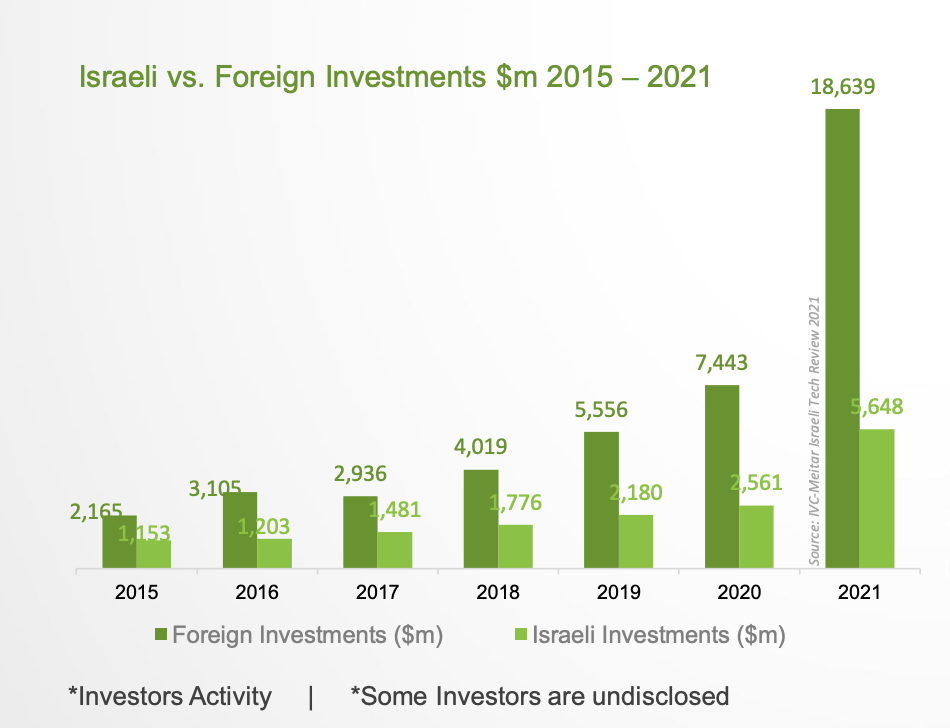

Israeli startups are on fire. According to the 2021 Tech Review report by IVC, Israeli tech startups attracted a record of $25.6 billion last year in 773 deals, more than double the $10.5 billion raised in 2020. Exits of Israeli startups in 2021 reached $82.4 billion, also a record amount. There are 80 Israeli unicorns, private companies valued at $1 billion or more, with 42 companies joining the Unicorn club in 2021 alone.

For the record, Startup Nation Central and Pitchbook share slightly higher numbers ($26.6 billion), who also compared Israel to other leading startup hubs:

When compared to growth rates of other countries based on comparative data compiled from PitchBook on January 1st, 2022, Israel’s 147% found itself at the top of the rankings, beating out traditional tech hubs like the US (93%), the UK (119%), Singapore (100%), Sweden (144%), Ireland (108%), and France (56%). The only countries that saw higher growth in tech investments were Germany (170%) and India (164%).

2021 Tech Trends: Israel is winning the global race for tech funding

Part of a global trend

Records were broken globally as well, both in terms of funding and number of unicorns. According to Crunchbase, Global venture investment reached $643 billion in 2021, compared to $335 billion for 2020—marking 92% growth year over year. In the US alone, startups raised $330 billion. In the UK, by far the largest tech hub in Europe, startups raised $26 billion.

To put things in context:

Risks and challenges for the Israeli startup ecosystem in 2022 and beyond

Will the golden age for Israeli tech continue this year? It’s not a question of will it go down, it’s a question of when. Some investors, like Avi Eyal, are already warning startups that winter might be coming and they should cut back on spending and make sure they have enough cash to survive until 2024.

What goes up must come down and cycles exist everywhere. If we are aware of what can go wrong, perhaps we have a chance to fix it. Below are some of the more pertinent challenges for Israeli startups in 2022:

Talent

- Shortage of talent – Israel is a country of 9 million people, and according to a recent report by the Israel Innovation Authority, only about 334,000, about 9.8% of the workforce, participate in the high-tech industry. The government set a goal to increase the percentage of people employed in tech t0 15% but it cannot be achieved overnight. The Israeli innovation authority deems the sector suffers from ‘chronic employee shortage’. The battle for talent has meant that companies had to lure potential employees with billboards, influencer videos, referral schemes, etc.

- Cost of talent – With increasing competition from the large tech companies (Israel has over 350 International R&D centres for some of the world’s biggest tech companies including Microsoft, Intel, Nvida, Google, Snap, TikTok, etc, startups must also compete with the growing stable of local unicorns like Rapyd, Monday, Playtika, Ironsource, etc) with their ever growing perks and higher salaries.

- Diversity – Women make up about 33% of the start-up workforce in Israel, according to a new report from Power in Diversity. In management positions, women representation is 23.3%. It’s much better than the UK, with 19% of women in tech in 2021 according to Tech Nation, but there’s still work to be done.

SPACs have backfired

There are two main forms of exits for startups: trade sale/M&A or IPO. SPACs had their moment in the sun in 2021, with a record number of companies choosing to go public using the SPACs in favour of traditional IPOs. Why do Israeli startups might find them attractive? I commented on this to Israel21c in the early days of the trend.

Many of the companies that went public via SPACs saw their valuations dramatically reduce in the months that followed post IPO. Both employees and investors typically have a 6 month lock up period (exceptions apply of course) so this can have devastating effects on liquidity and retruns. Examples include Riskified (which declined 70% post IPO), eToro (which saw its value dip at least 15%) REE and others. Given that some of these new stocks have low trading volume, in practice the lock up period can be longer.

This will make boards think twice before they choose the SPAC route for liquidity going forward (unless they don’t have a choice, in which case the writing was on the wall).

Tel Aviv became the most expensive city in the world

The Economist crowned Tel Aviv as the most expensive city in the world in 2021, a dubious title at best. This excludes real estate prices and relates mainly to cost of living (prices of goods). The effect is additional pressures on the talent costs mentioned above, where startups struggle to compete with larger players in the market.

In addition, the combination of rising prices (part of global and local inflation) and the historic strength of the NIS has meant that the funding startups raised (in USD) is worth less than it did a year ago. Anecdotally, one founder complained to me that this has shorten his runway by 30%. Several discussions on social media have founders asking if they should hedge their FOREX risk.

Global tech correction

Nobody really knows how long the current tech rally would last. January saw tech stocks rattle (read Fred Wilson’s the Selloff). Out of Israel’s $26 billion raised (approx), 73%, or $18.64 billion, was by foreign investors in 2021. A burst in the global financial markets will certainly have an impact on funding for Israeli startups. This is primarily the case for the US. Japan alone tripled its investments in Israeli startups in 2021, reaching $2.9 billion (15.8% of total foreign investments in 2021)

Mitigating Factors

The Israeli tech ecosystem also stands on some strong pillars that ensure its stability, at least in the short term.

Plenty of fresh powder in the market across stages

- Just in the past few months we’ve seen several new fund announcements

- Aleph: $300M (early stage)

- Grove ventures: $185M (early stage)

- StageOne: $150M (early stage)

- UpWest: $70M (seed)

- Key 1 Capital: $300M (growth)

- And several others….

In addition, Israel is getting increasing action (and on-ground presence) from some of the largest growth funds globally. This includes:

- Softbank Vision Fund – the with the appointment of former head of Mossad, Yossi Cohen, as partner

- Blackstone – with $619 billion under management globally. Blackstone added Yifat Oron to lead the local office, and the team has already invested in Wiz, a cybersecurity startup that reached $6 billion valuation in two years.

- Insight Partners – Insight manages more than $30 billion and was the most active fund in Israel in 2021 (with 46 rounds). This is even before serial entrepreneur Liad Agmon joins as partner. Several other hires are underway for the local office.

- Tiger Global – with $95 billion under management, Tiger doesn’t yet have a local office, but started placing bets in the market including a $47 million investment in Guardio, a consumer cyber startup.

- SPACs – despite of their poor performance, there are many active SPACs still out there searching for targets. Questions about the pipe loom, but nevertheless they will probably be deployed.

Education

Israel’s universities are some of the top in the world, especially when it comes to tech and entrepreneurship. In Pitchbook’s 2021 Ranking of the 50 Leading undergraduate programs that produce the most VC-backed entrepreneurs, 4 Israeli universities were ranked with Tel Aviv University in the top 10, and the Technion placed #12.

K-12 education is where the real challenges are. The government has a lot of work ahead to revamp the curriculum and ensure that the periphery and minorities are also versed in STEM subjects at the level of global tech hubs.

Strong foundations

- Sectors – Israel attracts about 30% of the global cybersecurity investments worldwide. It is also punching above its weight in semiconductors, health, food tech and gaming. The plethora of established companies and unicorns in these spaces should continue to create the next generation of founders.

- Culture – entrepreneurial culture and plenty of role models means that young graduates (from university or technical units in the army) see entrepreneurship as a viable career path. Israeli ‘chutzpah’ also has a role to play, giving young people a healthy disregard of the impossible and a ‘pushiness’ that’s needed to lift a startup off the ground.

- Global mindset – Israel’s local market is negligible, so founders have to think globally (typically that means US first) from day one.

- R&D expenditure as a percentage of GDP – Israel ranks 2nd globally in this metric, following closely after South Korea. The trend is expected to continue and is supported by government grants, the Israel innovation authority etc. These funds can help cover some of the R&D costs even in the case of less funding available in the private market.

Overall, I’m optimistic about the future prospects of Israeli startups in the years to come. With tech playing an ever growing role in every industry, and consumers spending more time and money online, Israeli startups might face increasing competition but are generally well positioned to win.

On a personal note, I feel privileged to play a small role in Israeli innovation with Remagine Ventures. I’ve had a chance to feel this year’s excitement up close, by cheering up on the movers and shakers in Israeli tech on my weekly #Firgun posts and newsletter. Keep on creating!

- Weekly Firgun Newsletter – May 9 2025 - May 9, 2025

- The “AI-First” Company: CEOs Signal a Paradigm Shift - May 7, 2025

- How Venture Capital Firms are Changing in 2025 - May 6, 2025