There’s been a few interesting posts this week on the flaws of the venture capital model and the perceived value that VCs provide to founders.

In “Only the paranoid survive“,Chamath Palihapitiya, managing partner at Social + Capital argues that the traditional venture capital funds tends to be reactive and is based on antiquated beliefs:

- ‘Differentiated dealflow’ – how relevant is it in the age of YC and AngelList?

- Passive sitting on boards waiting for companies to IPO

- Anecdotal vs. data led approach for running companies in the age of AI/ML

Chamath argues that like in tech, in order to stay relevant, VC must disrupt itself:

Scaling through technology is the only path and building valuable products is our only protection

To that end, Social + Capital has been building several product including Capital-as-a-Service, an algorithmic decision engine for deploying $50K-$250K tickets, without a single traditional venture pitch. Which could also mean, without the many biases engrained In other words, not a people business…

On the other side of the spectrum, in a recent post on Hackernoon, Henri Deshays at Newfund and Owen Reynolds from University of Chicago published the findings of a survey of 98 VCs and 121 founders. In a nutshell:

- “VCs overvaluing how much time they spend with their portfolio companies as well as their contributions compared to the founders’ perspectives”

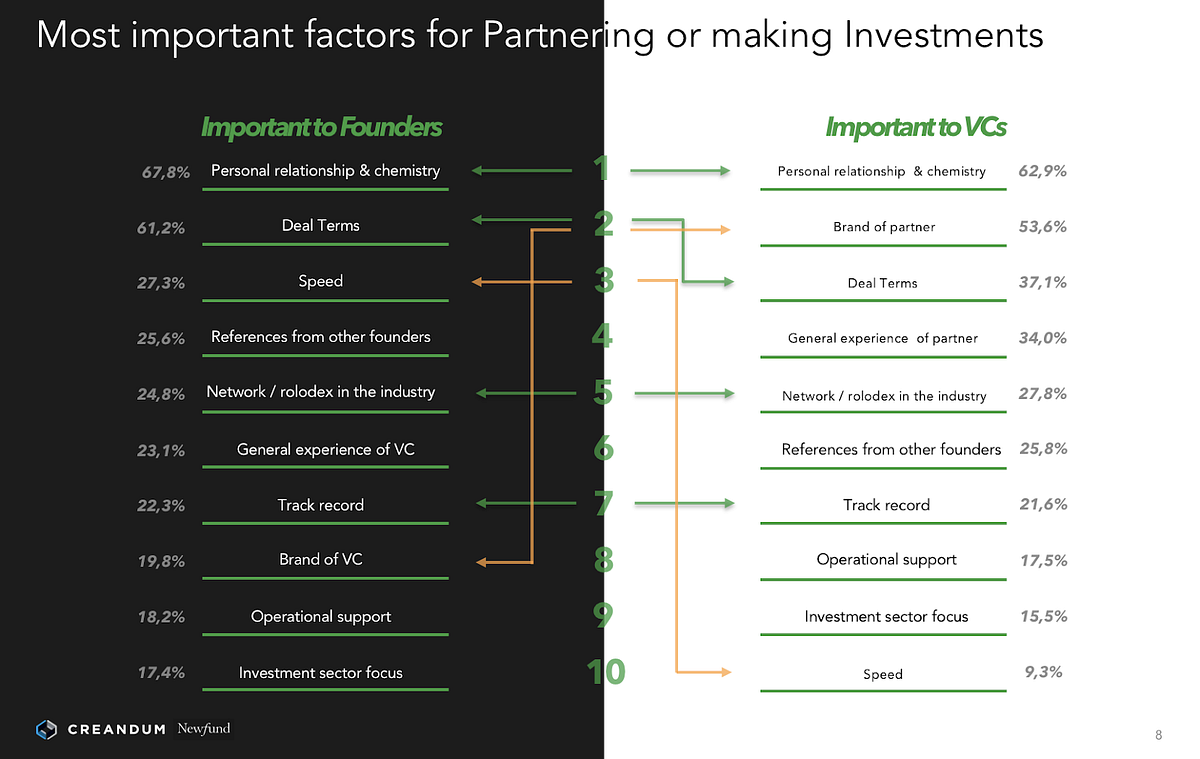

- Founders rank speed as their 3rd most important criteria and VCs, in fact, ranked it as the least important one.

- “Personal relationship & chemistry” with the counterpart are cited as the single most important driver for partnering with an investor/founder. In other words, very much a “people business”.

So here we have it, arguments in favour of VC as a people business, but also against. In my opinion, tech can play a big role in supporting the decision making process for investing, and VCs need to get more creative in developing their own tech stack, but at the end of the day it’s still a people business today. The chemistry and relationship remain an important factor in making ‘magic’ happen, but scale remains the biggest challenge. How many startups can a VC assess and actively support in a given week, when their time constraints only grow? I’d love to get the advice from folks who’ve been doing this longer…

- Founders need to adjust to longer cycles between rounds - April 25, 2025

- Weekly #FIRGUN Newsletter – April 25, 2025 - April 25, 2025

- Weekly Firgun Newsletter – April 18 2025 - April 18, 2025